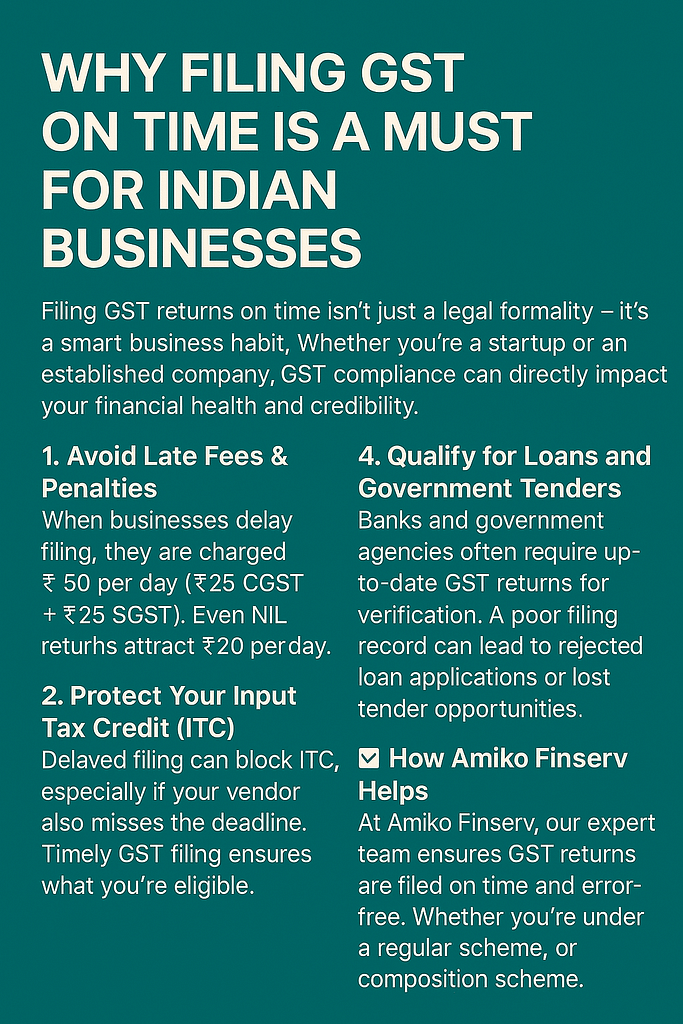

Filing GST returns is more than just a legal formality — it’s a business discipline that keeps your operations smooth, compliant, and credible. If you’re running a business in India, filing GST on time is not optional; it’s essential.

1. You Avoid Late Fees & Penalties

When you file your GST return late, the government imposes a penalty of ₹50 per day (₹25 CGST + ₹25 SGST). Even a NIL return attracts ₹20 per day. Therefore, even a short 10-day delay can lead to a fine of ₹200 to ₹500, all for nothing.

2. You Keep Your Input Tax Credit (ITC) Safe

Delaying your GST return can block your Input Tax Credit, especially if your supplier also files late. As a result, your working capital gets affected, and you may end up paying more than necessary. Timely filing ensures smoother cash flow and better cost management.

3. You Strengthen Your Business Reputation

Clients, vendors, and financial institutions often check your GST compliance history. By consistently filing on time, you improve your GST rating and build trust. On the other hand, frequent delays can make your business appear unreliable and disorganized.

4. You Boost Your Chances with Loans & Tenders

Banks and government bodies usually ask for your GST return records when you apply for a loan or tender. If your filings are irregular, they may reject your application. Timely GST filing, therefore, opens more doors for funding and contracts.

5. You Avoid Government Notices

The GST Department closely monitors non-filers. If you miss deadlines regularly, the department may issue notices or even initiate audits. To stay stress-free and compliant, it’s smarter to file on time than to face unnecessary complications.

✅ How Amiko Finserv Helps You Stay Ahead

At Amiko Finserv, our expert CA team actively monitors deadlines and files your GST returns on time, every time. Whether you’re under the regular scheme or the composition scheme, we make sure your business stays compliant and penalty-free.

📞 Contact Us Today:

9718282653 | 8588013069

📧 amikogroup.in@gmail.com

🌐 www.amikofinserv.com