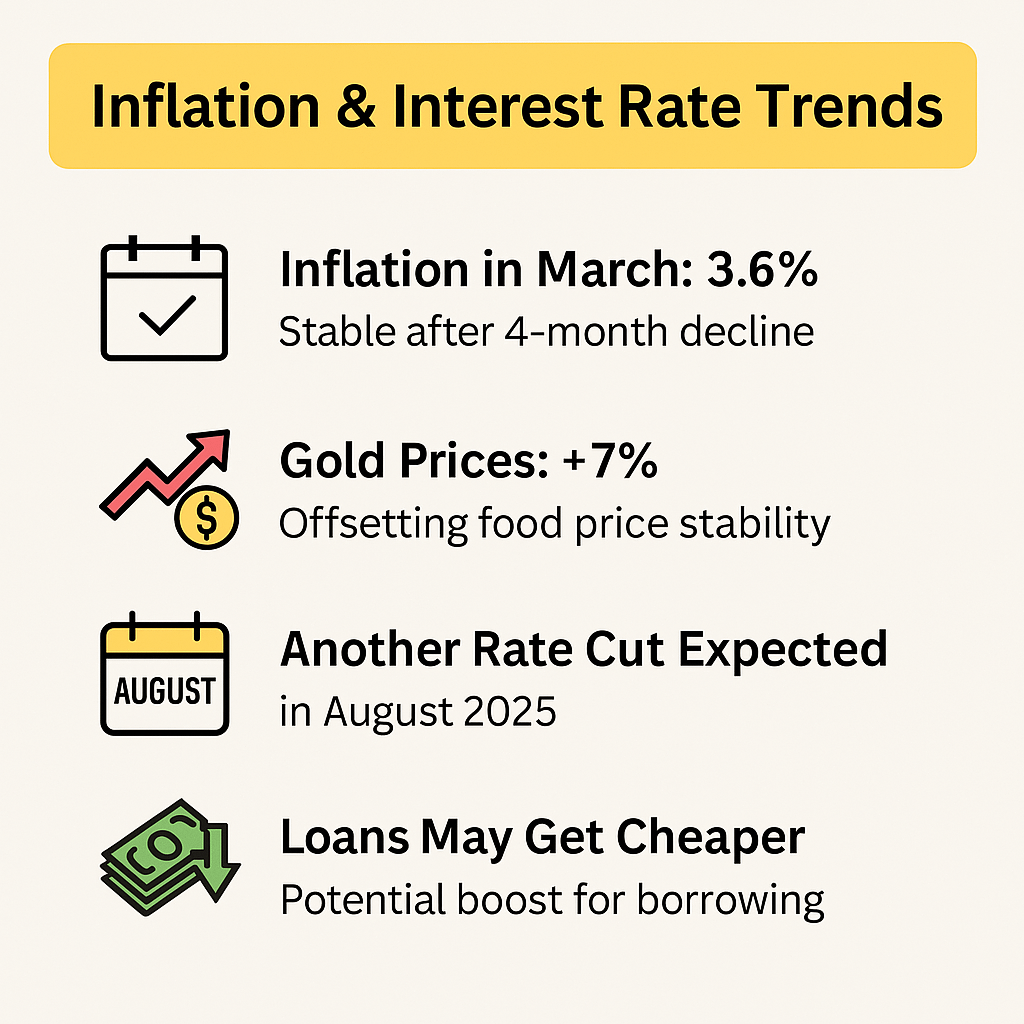

India’s economy is witnessing a shift — inflation and interest rates in India are evolving, with March inflation at 3.6%, gold prices rising, and a potential interest rate cut expected by the RBI. These changes impact loans, investments, and overall financial decisions.

At Amiko Finserv, we decode these trends to help individuals and businesses make smarter choices. 💼📊

📊 Inflation and Interest Rates in India: March 2025 Overview

According to the MoSPI, retail inflation stood at 3.6%, showing price stability for the first time in months.

Key Highlights:

- Food prices: Largely stable

- Gold prices: Jumped by 7%

- Fuel: Controlled through subsidies

This inflation stability affects how interest rates in India will move further in 2025.

🪙 Gold Price Surge & Investment Impact

Gold has spiked due to:

- Global tensions (Middle East, crude oil prices)

- High demand from Indian weddings & festivals

- Depreciating INR against USD

💡 Smart Move: Use Gold SIPs rather than bulk buying at high prices.

💬 For daily gold rate updates, visit MCX India

🏦 Interest Rates in India: RBI’s Next Move?

After dropping the repo rate to 6%, the RBI is expected to cut rates again in August 2025 to stimulate economic growth.

This change in interest rates in India will affect:

- 📉 Loan EMIs (reduced)

- 🧾 Business capital (easier to access)

- 💰 Investment strategy (especially debt funds)

💡 What Should You Do Now?

| Area | Action |

|---|---|

| 🏠 Loans | Refinance to lower EMIs |

| 📊 Investments | Focus more on debt & hybrid funds |

| 🧮 Tax Planning | Combine interest savings with smarter deductions |

| 🪙 Gold | Avoid emotional buying — go for SIPs |

Also, consult a CA for personalized strategies during such transitions.

🤝 Expert Help from Amiko Finserv

We recommend:

- Tracking every change in inflation and interest rates in India

- Planning your business/personal loans in advance

- Diversifying your investment portfolio

- Filing taxes smarter with CA guidance

Need assistance? We’re just a call away.

📞 9718282653 / 8588013069

📧 amikogroup.in@gmail.com

🌐 www.amikofinserv.com