💡 Introduction

Income Tax Slabs 2024 have been updated for the financial year. Now, every taxpayer has to make a smart decision — stick with the Old Tax Regime or go for the simplified New Tax Regime?

If you’re confused, don’t worry. This blog will break down the latest income tax slabs and help you choose the right regime based on your financial situation.

📌 Check official updates on:

Income Tax Portal | CBIC GST Site

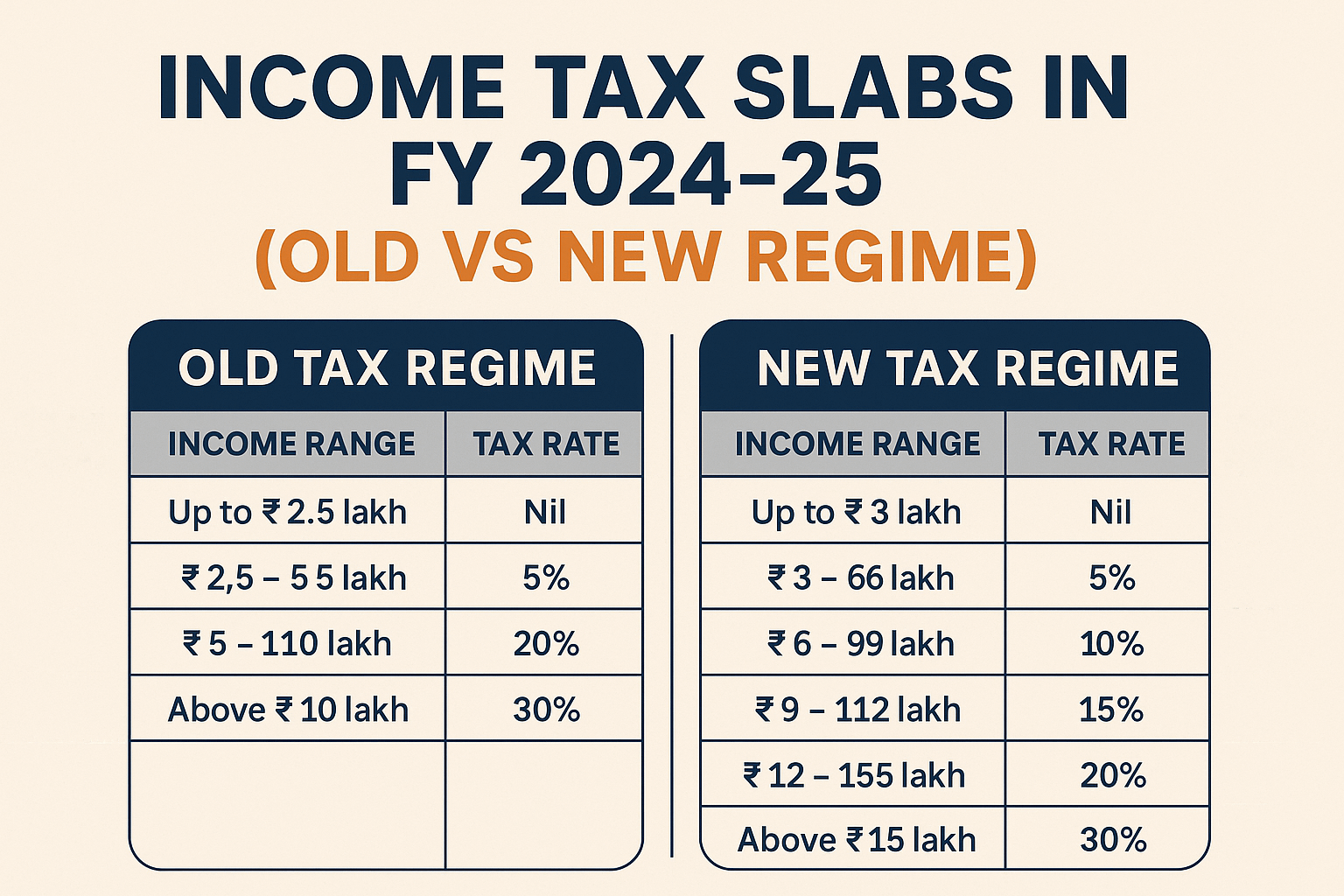

📌 Income Tax Slabs 2024 (Old Regime)

Under the Old Tax Regime, taxpayers can claim various deductions like:

- Section 80C (LIC, ELSS, PPF)

- Section 80D (Medical Insurance)

- HRA, LTA, home loan benefits

But tax rates are slightly higher.

| Income Range | Tax Rate |

|---|---|

| Up to ₹2.5 lakh | Nil |

| ₹2.5 – ₹5 lakh | 5% |

| ₹5 – ₹10 lakh | 20% |

| Above ₹10 lakh | 30% |

🧓 People aged 60 years or above get a higher exemption limit of ₹3 lakh.

📌 Income Tax Slabs 2024 (New Regime)

The New Regime offers reduced tax rates but removes most deductions. However, from FY 2023-24, a standard deduction of ₹50,000 is now available even in the new regime.

| Income Range | Tax Rate |

|---|---|

| Up to ₹3 lakh | Nil |

| ₹3 – ₹6 lakh | 5% |

| ₹6 – ₹9 lakh | 10% |

| ₹9 – ₹12 lakh | 15% |

| ₹12 – ₹15 lakh | 20% |

| Above ₹15 lakh | 30% |

✅ Ideal for people with fewer investments and deductions.

⚖️ Old vs New Regime: Which One is Better in 2024?

| Factor | Old Regime | New Regime |

|---|---|---|

| Deductions | Many available | Very limited |

| Tax Rates | Higher | Lower |

| Best For | Salaried with investments | People with simpler income |

💡 Pro Tip:

If you actively invest in LIC, PPF, or claim HRA – Old Regime is usually better. For people who don’t want complex deductions, the New Regime is more tax-efficient.

📢 Amiko Finserv’s Tax Expert Advice

“Choosing the wrong tax regime may cost you thousands. Let our CA experts evaluate your case and suggest the best route.”

📞 Need Help with Tax Filing?

Let Amiko Finserv Pvt Ltd take the stress out of taxes. We offer:

- Regime comparison

- Accurate ITR filing

- Legal tax-saving solutions

📲 Call us: 9718282653, 8588013069

📧 Email: amikogroup.in@gmail.com

🌐 Visit: www.amikofinserv.com