👋 Introduction

Starting a business?

Then, registering for GST is one of the first legal steps every entrepreneur should take ✅

👉 Hindi mein bolein toh – business shuru karte hi pehla kaam hota hai GST registration. Bina iske aapka business legally incomplete maana jaata hai.

This blog will walk you through the GST registration process, the documents you’ll need, and how Amiko Finserv can simplify the whole journey for you.

👀 Who Needs GST Registration?

Not every small business owner knows this — but GST registration becomes mandatory under several conditions:

- If your business turnover exceeds ₹40 lakhs (₹20 lakhs for service providers)

- In case you’re selling online, through Amazon, Flipkart or your own website

- When you supply goods or services across different states

- If you run a seasonal/casual business

- Or when you want to claim Input Tax Credit (ITC)

👉 In short, agar aap online bech rahe ho, ya turnover achha hai, toh GST registration lena zaroori hai.

📃 Documents Required

Before you begin, make sure you have the following documents ready 👇

1️⃣ PAN Card of the business or individual

2️⃣ Aadhaar Card

3️⃣ Owner’s passport-size photograph

4️⃣ . Address proof of the business premises 🏠

5️⃣ Bank details — like a cancelled cheque or passbook

6️⃣ Digital Signature Certificate (DSC) — needed for LLPs & Companies

📌 Note: Individual proprietors usually don’t need a DSC.

Having these documents beforehand helps avoid delays. Moreover, it ensures that your application gets processed smoothly.

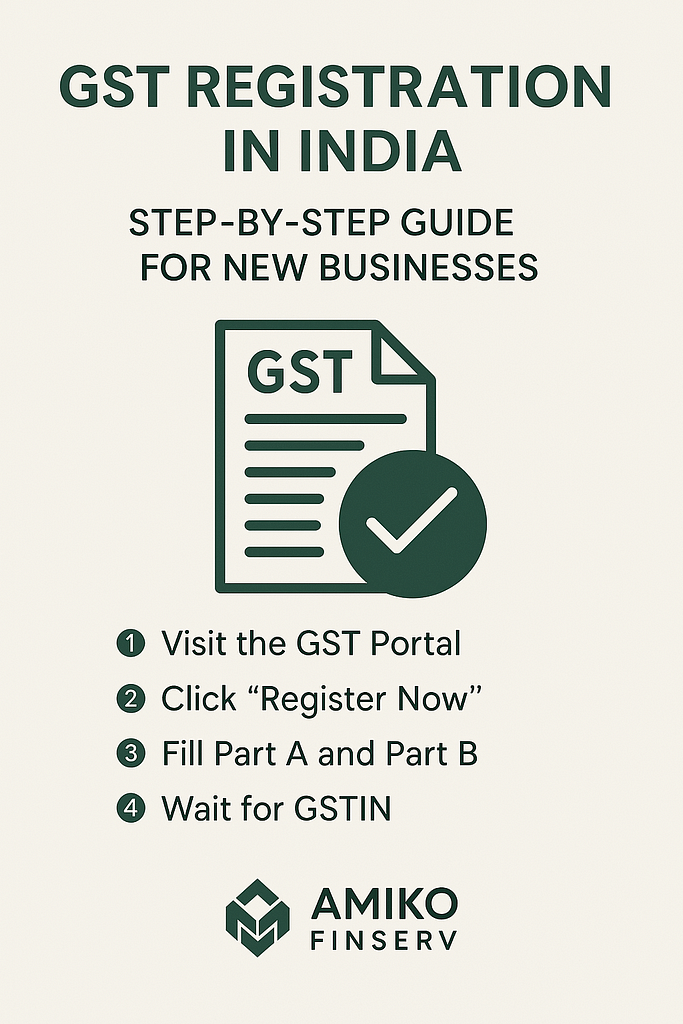

🧭 Step-by-Step GST Registration Process

The process might look long, but it’s actually quite simple when broken down:

🔹 Step 1: Visit www.gst.gov.in

🔹 Step 2: Click on “Register Now” under the Taxpayers tab

🔹 Step 3: Fill Part A with basic info – PAN, email, and mobile number

🔹 Step 4: Verify details using the OTP received on mobile/email

🔹 Step 5: Note down the Temporary Reference Number (TRN)

🔹 Step 6: Log in using TRN to fill Part B – business info, bank details, etc.

🔹 Step 7: Upload required documents

🔹 Step 8: Submit your application using either DSC or EVC

🔹 Step 9: Wait for verification by a GST officer (usually takes 3–7 working days)

🔹 Step 10: If all is good, you’ll receive your GSTIN via email

Meanwhile, keep an eye on your registered email or mobile for updates from the portal.

💡 Benefits of GST Registration

Now, let’s talk about why it’s smart to register for GST — even if your turnover isn’t mandatory-level yet:

✔️ Legal recognition of your business

✔️ You can collect GST from customers

✔️ Access to Input Tax Credit, saving money 💰

✔️ Eligible to sell on e-commerce platforms

✔️ Builds trust among customers and vendors

Furthermore, timely registration helps you avoid penalties and confusion during audits.

🛟 How Amiko Finserv Can Help

We get it — the GST process can be confusing, especially if you’re handling everything yourself.

But that’s where Amiko Finserv comes in.

We take care of your entire GST registration process — from document collection to GSTIN approval.

✅ Zero Errors

✅ Expert CA Support

✅ Quick Processing

✅ Personalised Guidance

📞 Call Us: 9718282653 / 8588013069

📩 Email: amikogroup.in@gmail.com

🌐 Website: www.amikofinserv.com

🧾 Conclusion

Starting a business is exciting — but don’t let the legal side slow you down.

GST registration isn’t just a requirement — it’s a foundation for future growth.

So, why wait?

📌 Register today, and if you need support, Amiko Finserv is always here to help you grow!